- The Daily Vroom

- Posts

- $12,300 → $102,300. Only at Auction

$12,300 → $102,300. Only at Auction

PLUS: If You Sell the Cars, Why Not Insure Them Too?

The Daily Vroom

Value Is Determined in the Room

The hammer drops. The crowd cheers. The camera pans to a smiling bidder holding up a paddle like he just won the lottery.

And somewhere on the internet, thousands of car people are staring at their phones thinking… what the hell just happened?

Because this past week gave us two of those moments.

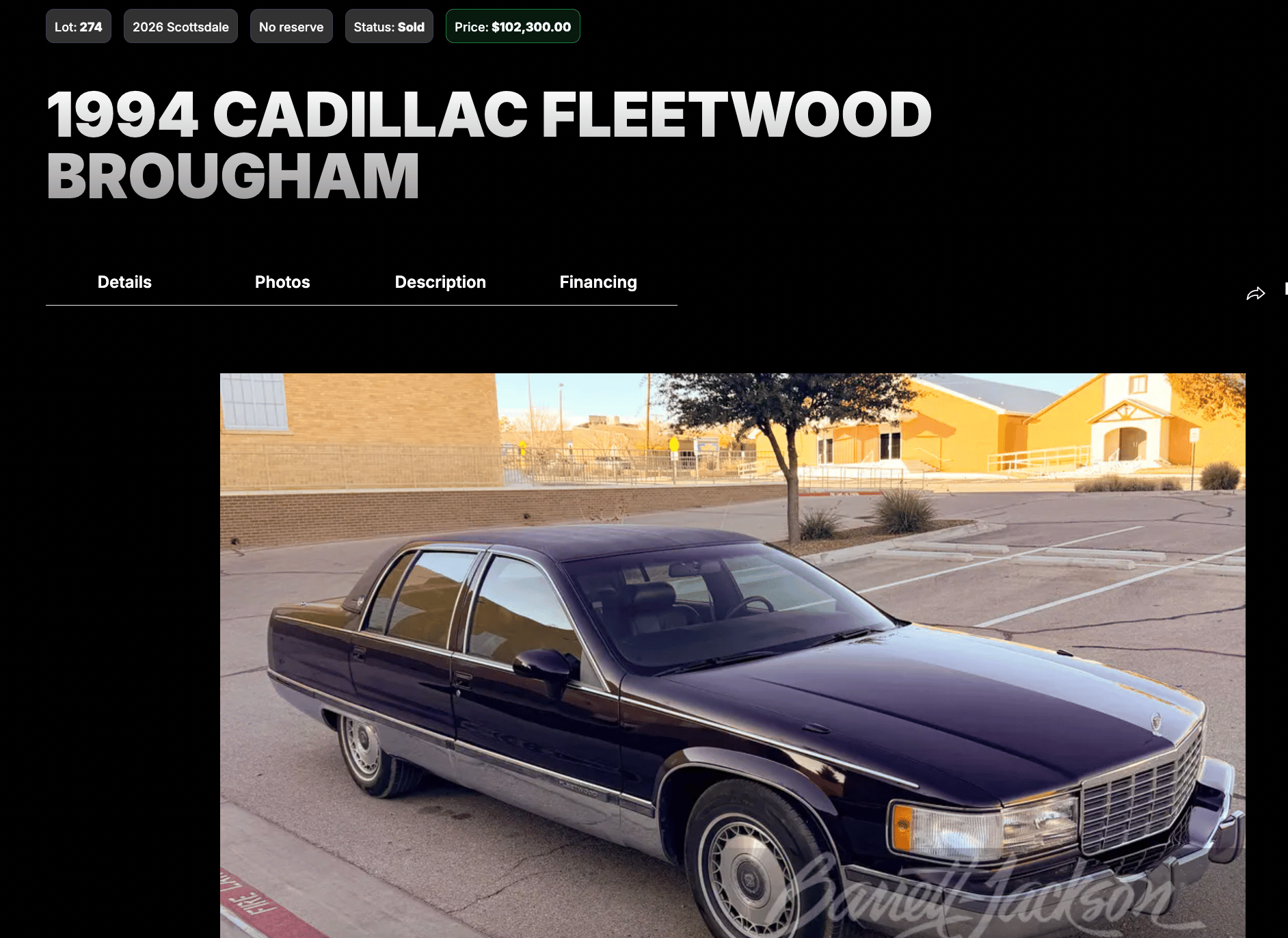

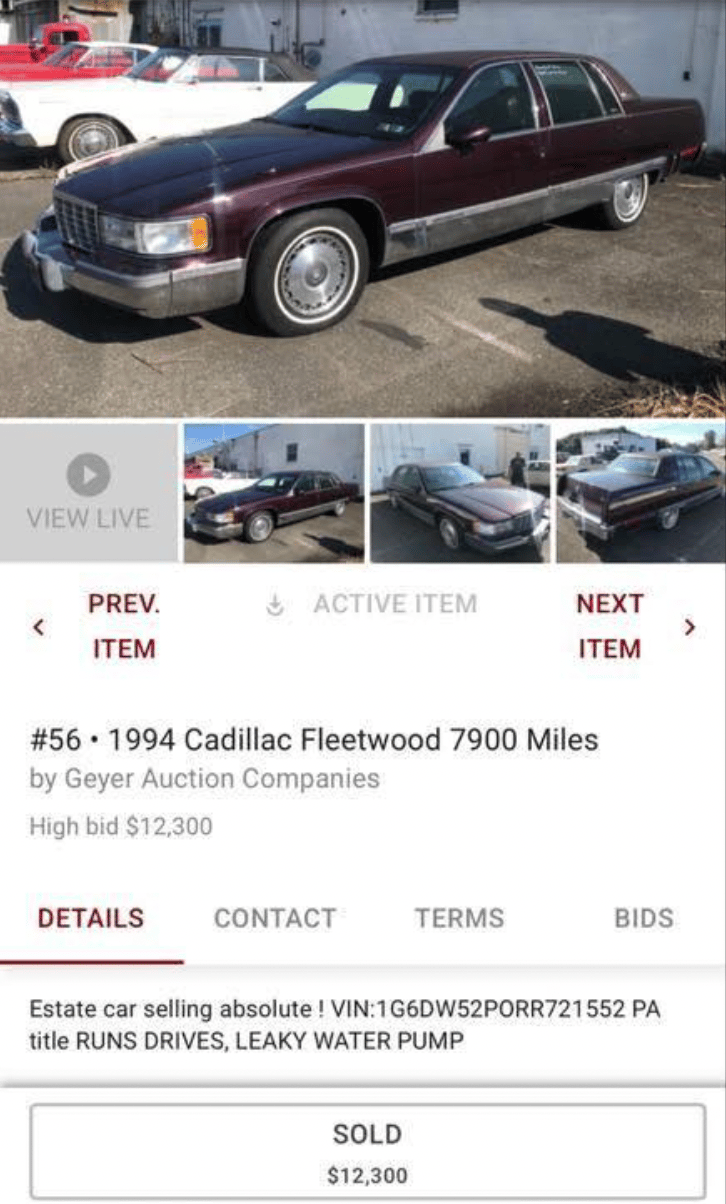

First, a 1994 Cadillac Fleetwood Brougham. Big, floaty, nice cruiser. The kind of car you normally see parked outside a diner, not headlining an auction. Word is it changed hands not long ago for $12,300. At Barrett-Jackson, under the lights, it brought $102,300. Same car. Same era. Same reality. Just a different stage and suddenly it’s a six-figure collectible.

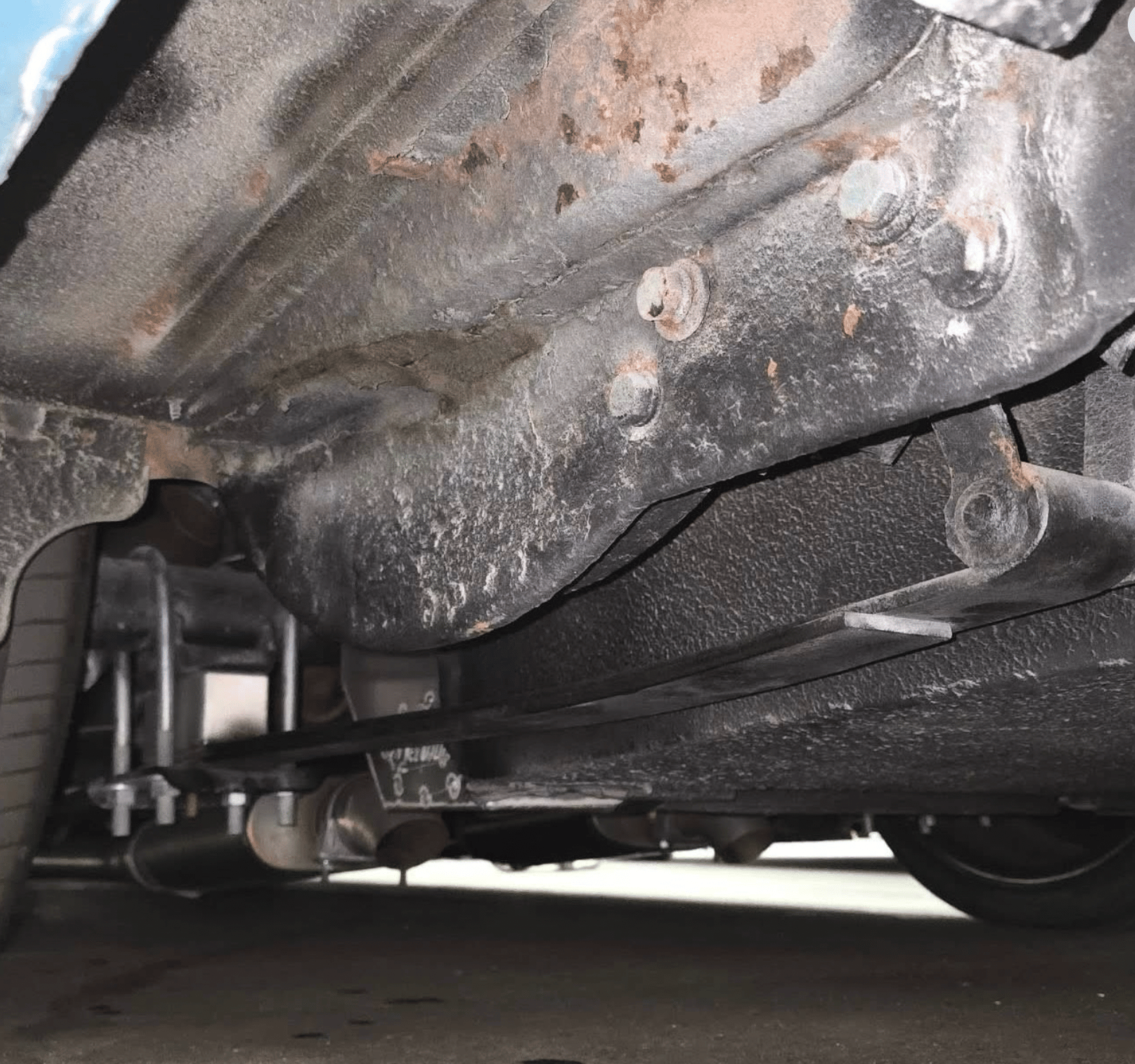

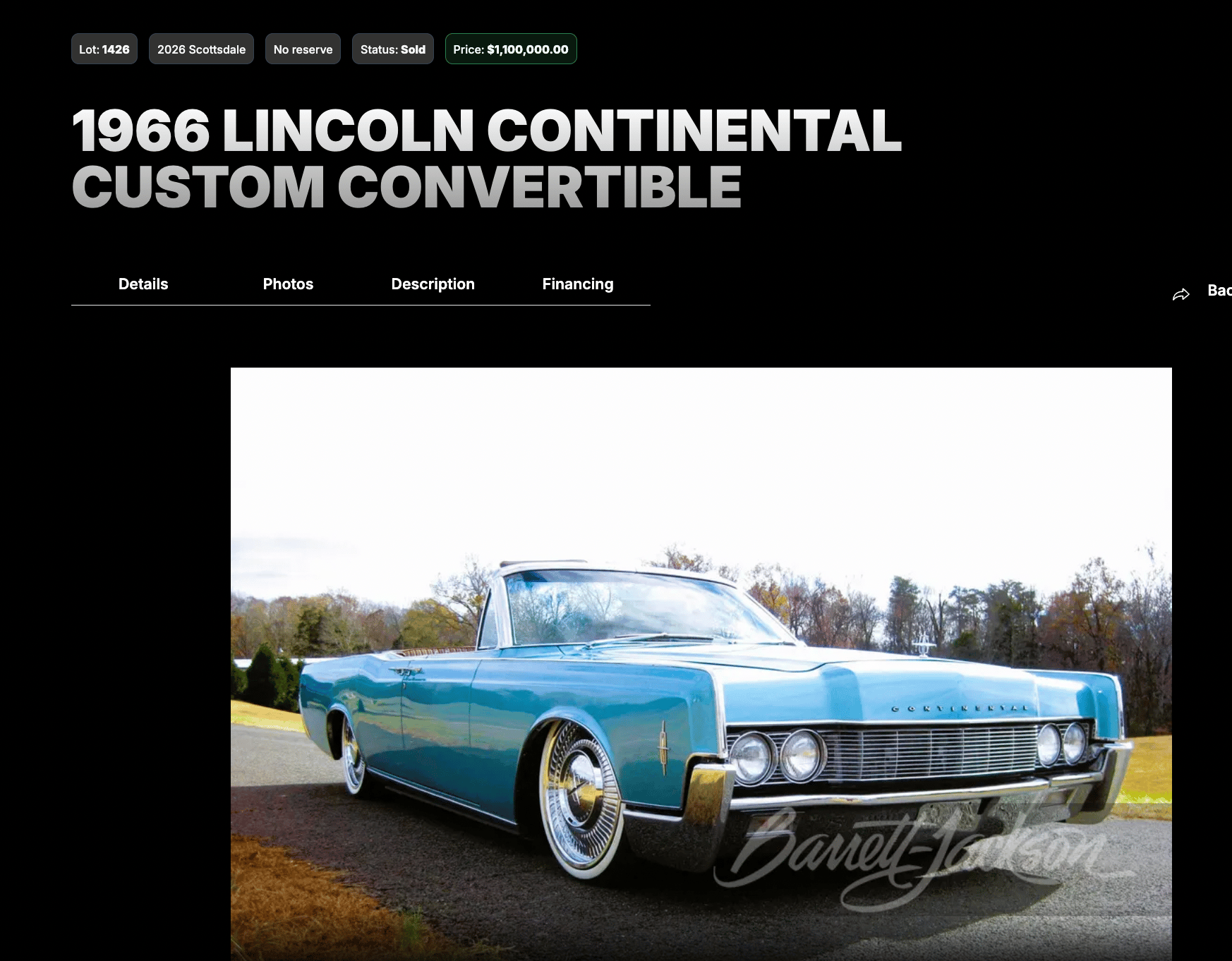

Then came the Lincoln. A custom ’66 Continental convertible that stormed all the way to $1 million. Seven figures. For a car that looked killer from 20 feet and… let’s just say less convincing underneath (see below). The underbody photos floating around tell a very different story. More driver-quality than concours. More spray can than sculpture. Yet in the room, none of that mattered. Two bidders wanted it. The number kept climbing. Game over.

Cue the comments.

“Money laundering.”

“Drunk bidders.”

“Fake TV numbers.”

We’ve all seen it.

But honestly you don’t need a conspiracy theory to explain this stuff. You just need to understand how live auctions work.

I’ve been to both Barrett-Jackson and Mecum more times than I can count. I’ve bought well. I’ve overpaid. I’ve watched steals roll through and I’ve watched absolute head-scratchers bring moon money. What both companies are world-class at isn’t just selling cars. It’s putting on events. They create theater. Energy. Urgency. A room where winning feels better than being rational. When you compress the decision into a few minutes, logic gets replaced by adrenaline.

That’s how a $12k Fleetwood becomes a $102k “must-have.”

That’s how a million-dollar Lincoln happens even when the underside isn’t exactly Pebble Beach.

Now compare that to online.

Online auctions are slower and honestly way less romantic. But they’re brutal in a good way. You get seven days. Thousands of obsessive, knowledgeable buyers. People zooming into photos, asking for cold starts, service records, undercarriage shots, paint meter readings. Every flaw gets dragged into daylight. It’s crowdsourced due diligence. The price usually settles into something that feels… explainable.

Live auctions don’t do explainable. They do emotional. And that’s why I always say this, and weeks like this prove it: Value is determined in the room on a particular day.

Not comps. Not logic. Not what the internet thinks it’s “worth.” Just who showed up… and how badly they wanted to win.

Those $102K and $1M results… what’s really driving prices? |

Insurance Was Always the Obvious Next Move

If you already have the audience, the trust, and the intent… why send that value somewhere else?

This week Car & Classic flipped the switch and launched their own specialist insurance offering, letting users quote and buy cover directly on the platform. Not a clunky referral. Not “talk to this partner.” Just… seamless. You’re already there looking at your next car, and now you can insure it in minutes. Done.

It’s one of those launches that makes you pause and think: yeah, that was sitting in plain sight the whole time.

Because look at the setup.They’ve got millions of monthly visitors, all enthusiast traffic, all high intent. People researching, bidding, wiring money, refreshing listings at midnight. Not casual browsers. Buyers. And the second someone wins a car, what’s the very next thing they need? Insurance.

Distribution + trust + niche focus.

That’s basically the cheat code for financial products.

Most insurers spend a fortune trying to reach exactly this customer. Car & Classic already owns the relationship. So instead of handing that moment off to a third party, they just kept it in-house.

And honestly, we’ve already started seeing pieces of this model over here too. Shipping quotes. Finance options. Some platforms make it feel completely natural, almost invisible. Click, done, handled. Others… still feel like you’re getting pushed out to a 2007 lead form. Same idea, very different execution. The winners are the ones that make it feel native, not bolted on.

That’s the bigger shift happening right now. The auction or listing isn’t the business anymore. It’s the entry point.

The real business is the ecosystem around the transaction. Insurance. Financing. Transport. All the boring stuff that actually carries margin.

Carvana figured this out years ago. Zillow did too. Now collector car marketplaces are catching up fast. And culturally, it fits Car & Classic perfectly. Insurance by enthusiasts, for enthusiasts. Not some generic policy where you have to explain why your agreed value Alfa or air-cooled Porsche isn’t “just an old car.” That credibility matters in this niche.

Side note I loved: they tapped Chris Harris for the announcement video (below). Which is a fun little wink if you follow the space, considering his Collecting Cars history and the friendly rivalry between platforms. Smart brand play. These companies aren’t just marketplaces anymore. They’re media companies with ecosystems.

Big picture, this is just good business. If you control the audience, you should control the economics. Otherwise you’re just passing the best part of the transaction to someone else.

Enjoying The Daily Vroom?

Pay it forward by sharing this newsletter with an automotive aficionado in your circles. Your endorsement allows us to accelerate our growth.

Send them to thedailyvroom.com to subscribe for free.

Reply