- The Daily Vroom

- Posts

- August Market Check: Who’s Winning, Who’s Slipping

August Market Check: Who’s Winning, Who’s Slipping

PLUS: The models carrying the summer market..

The Daily Vroom

Good Morning Vroomers,

As it’s the beginning of September, let’s talk about what happened in August 2025. One month of sales, one snapshot of the market. To put it in context, I like to line it up against August 2024. That way we get a feel for how the summer market is moving, and whether the chatter I keep hearing matches reality. For my data nerds, yes, it’s just a month. I’m with you. But it’s still a useful glimpse at where momentum is building and where it’s fading.

Before we dive into the details, let’s set the stage. In August 2024, online auctions moved $194 million worth of cars at an average of $42k per sale. Fast-forward to last month and the numbers ticked considerably higher, $206 million in sales with an average price of $46k. Bigger volume, higher averages. A market that’s moving in an upward trajectory.

Let’s dig into those numbers and more.

🛑 STOP! |

If you’re enjoying The Daily Vroom, then please pay it forward by sharing this newsletter with an automotive aficionado in your circles. Your endorsement allows us to accelerate our growth. Send them to thedailyvroom.com to subscribe for free. |

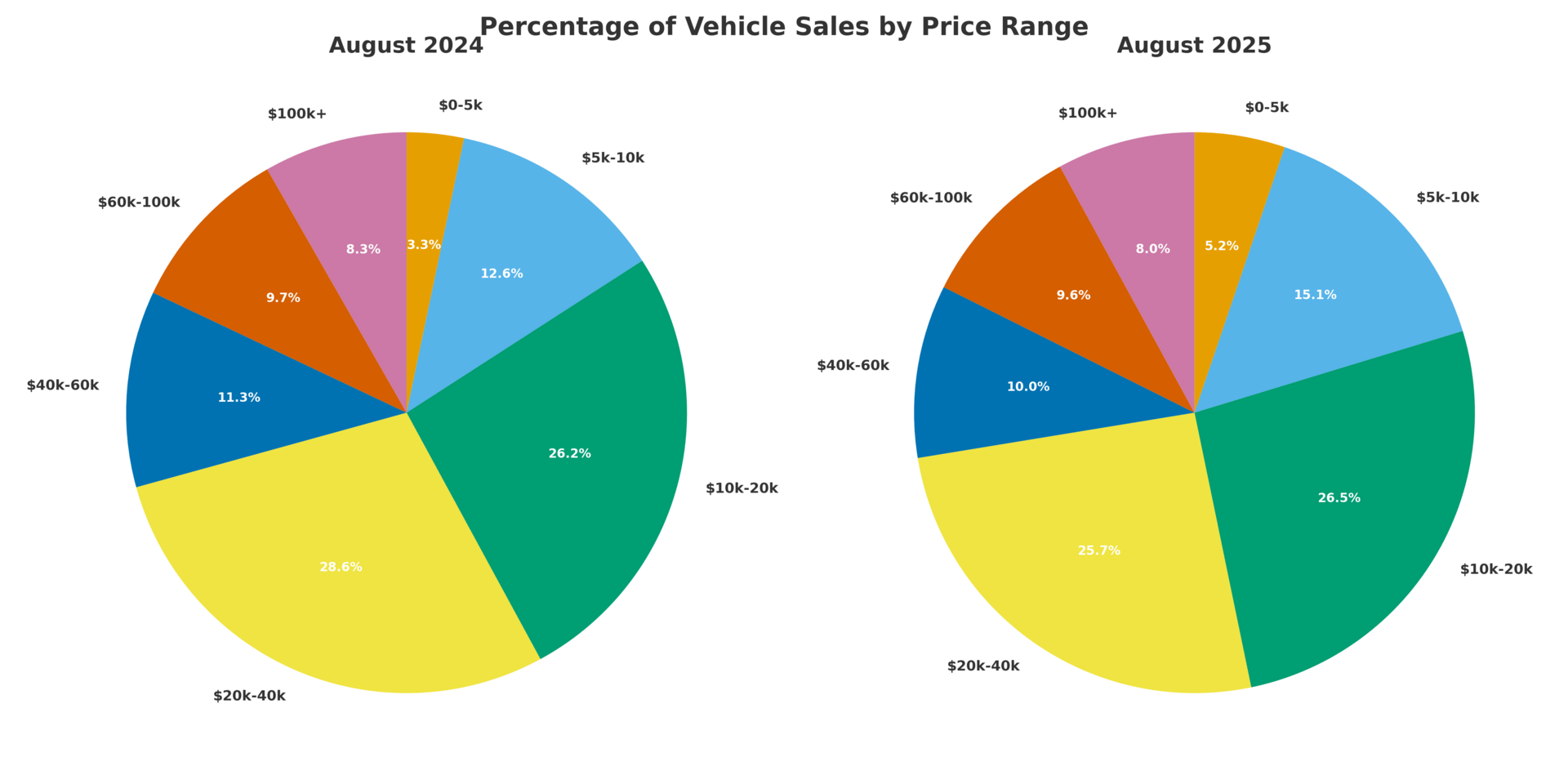

Vehicle Sale By Price Range

The price mix tells us how the market is stacked. In both August 2024 and 2025, the bulk of sales sat in the $20k–$40k bracket, followed by steady volume in the $10k–$20k range. The high end showed a shift: cars selling for $100k+ grew as a share of total sales in 2025, while the mid-tier $40k–$60k bracket eased back slightly.

The takeaway is balance. Affordable segments continue to drive most of the action, but the very top of the market pulled a little more weight in 2025, suggesting stronger appetite for premium cars.

Top 10 Car Makes

Porsche once again sets the pace and it’s almost entirely thanks to the 911. That model alone dwarfs every other Porsche line, with Cayenne and Boxster adding secondary volume.

Mercedes-Benz keeps its footing, powered mainly by the SL family. From modern SLs to the classics, that badge accounted for more sales than any other Mercedes model in both years.

BMW’s presence is built on the 3 Series. It’s the backbone of their sales in 2024 and 2025, leaving the higher-end lines as supporting players.

So while the leaderboard looks familiar, the detail shows it’s really a story of three workhorses: the 911, the SL, and the 3 Series.

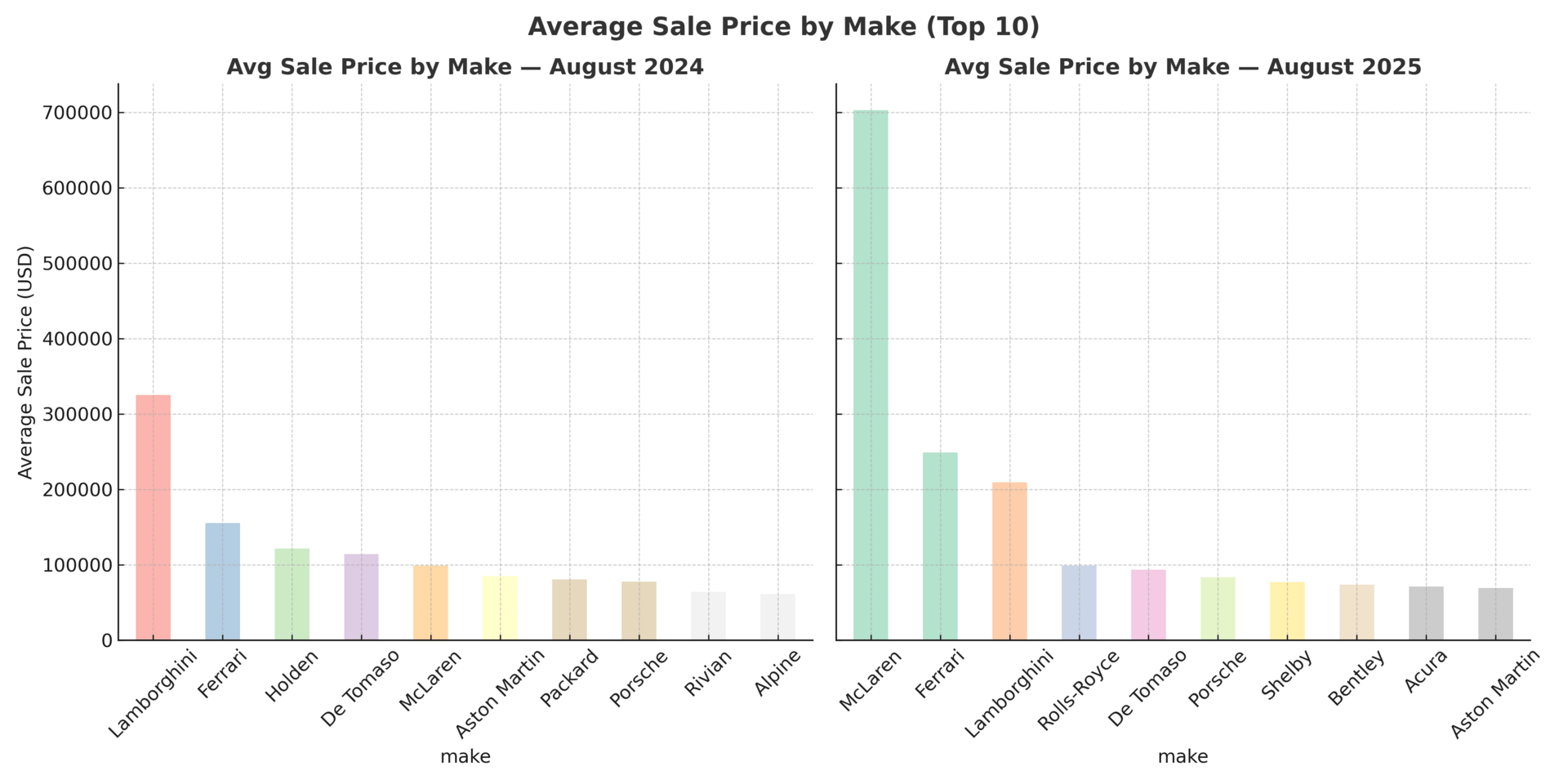

Average Sale Price by Make

The averages tell the story. Ferrari surged jumping from ~$155k in 2024 to nearly $250k in 2025, the sharpest move of any top brand. Porsche crept higher, up from ~$78k to ~$84k. Mercedes-Benz also climbed, moving from ~$43k to ~$48k. BMW stayed flat, holding in the mid-$20k range.

The broader picture is clear: high-dollar brands keep stretching their lead, while mainstream German marques remain stable.

Top 10 Models By Sales

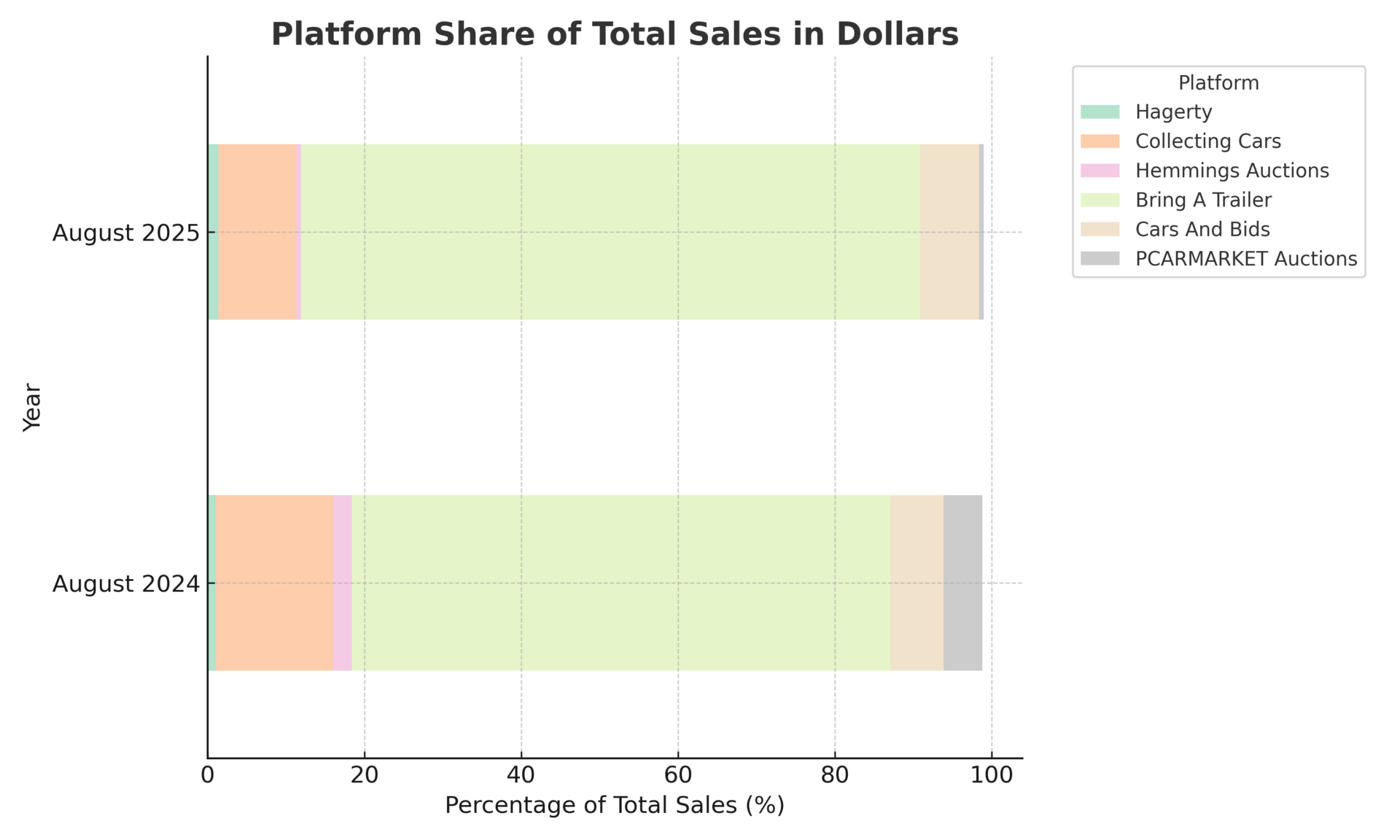

Platform Share of Total Sales

Measured by dollar volume, Bring a Trailer continues to tower over the market, growing from 68.7% in August 2024 to 79.0% in 2025. Cars & Bids inched up from 6.8% to 7.5%, while Collecting Cars slid back from 14.9% to 9.9%.

Among the smaller players, Hemmings lost share, dropping from 2.4% to just 0.6% while Hagerty ticked upward, from 1.1% to 1.4%. Both remain small in absolute terms, but their trajectories show how tough it is to fight for relevance while BaT consolidates control.

The message is clear: the money is concentrating at the very top, and the rest of the field is either treading water or shrinking.

Heatmap of Sales Counts

I get it. Heatmaps can be a lot. At first glance it feels like sensory overload. Too many blocks, too many colors. But give it a second. Let your eyes adjust. The patterns jump out. You start to see where the volume really sits and which ranges carry the weight.

The heatmaps make brand positioning obvious. BMW dominates the entry brackets, most of its volume sits in the $10k–$40k range. Mercedes-Benz spreads wider, with healthy counts in both the mid-market and the $40k–$60k tier.

Porsche is skewed higher, stacking sales in the $40k–$100k+ brackets, while Ferrari is almost entirely six-figure territory. The split between 2024 and 2025 shows Porsche nudging further upmarket, with fewer cars in the sub-$40k band, and Mercedes holding steady.

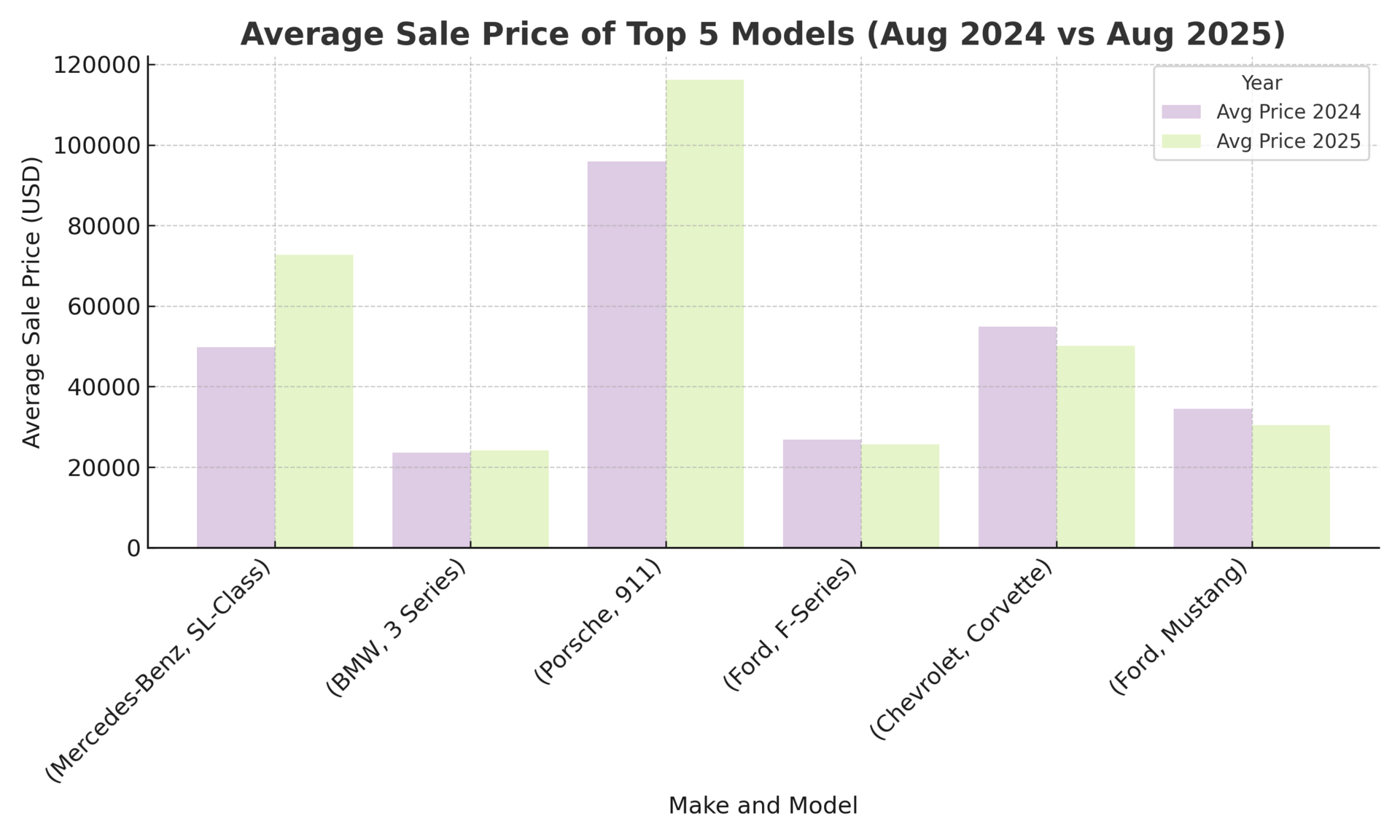

Average Sale Price of Top 5 Models

The averages reveal clear winners and losers year over year. Mercedes-Benz SL-Class surged, climbing from ~$50k in 2024 to more than $72k in 2025. The Porsche 911 also gained, moving from ~$96k to ~$116k.

At the other end, the Chevrolet Corvette slipped, averaging ~$55k in 2024 but closer to $50k in 2025. Ford’s F-Series held steady in the mid-$20k range, while BMW’s 3 Series barely moved, flat around $24k.

The takeaway: core icons like the SL and 911 are stretching higher, while volume staples like Corvette and F-Series are stuck or softening.

Average Sale Price By Day of The Week

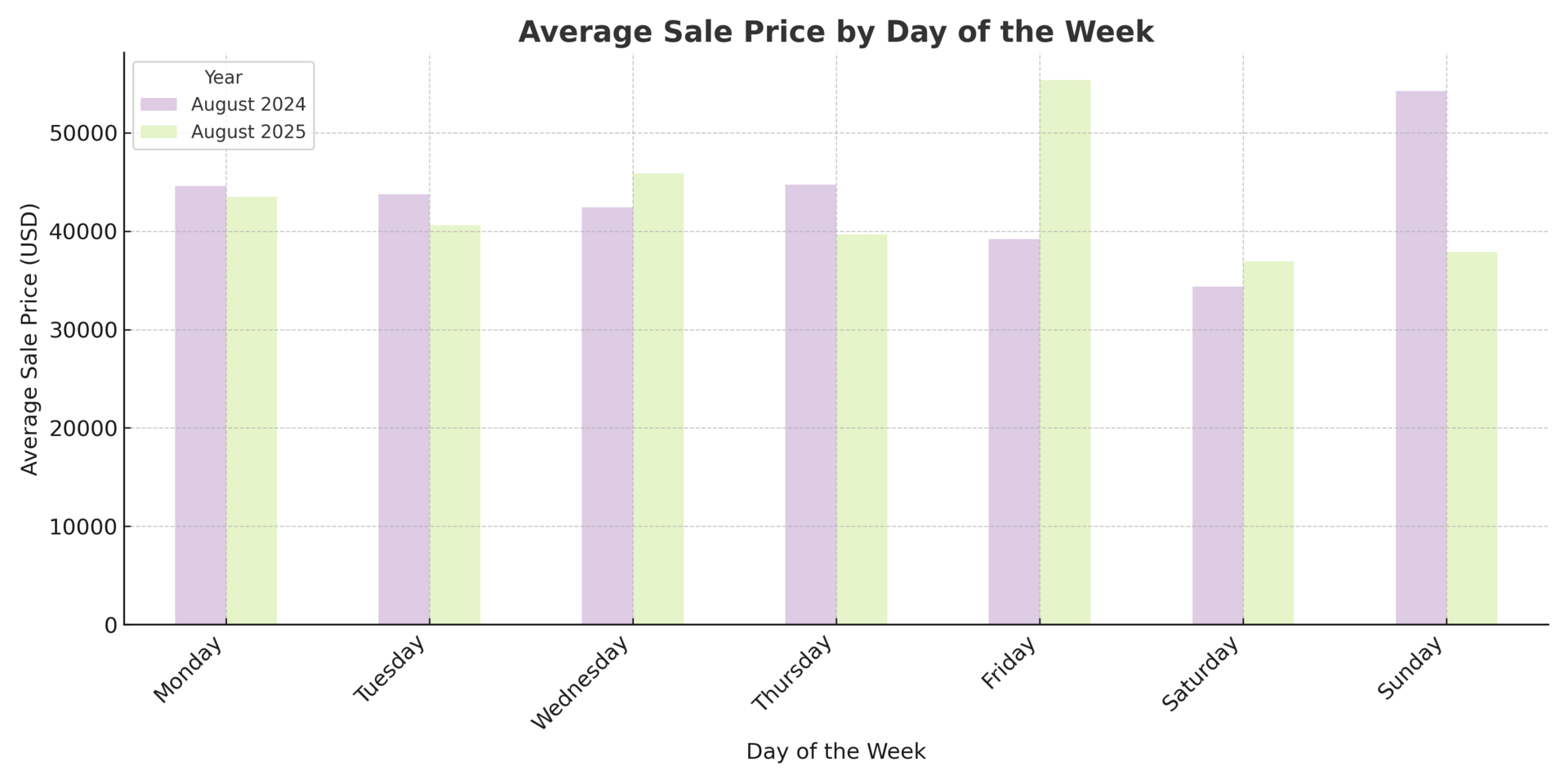

I’ve long argued weekends bring stronger money, and the numbers mostly back it up. In both 2024 and 2025, Saturday and Sunday average prices sit near the top of the week. Fewer distractions, more time on devices, and bidders willing to stretch.

Weekdays, especially mid-week, show flatter averages. Monday and Tuesday tend to trail the pack, with only Thursday occasionally punching above its weight.

The takeaway: timing matters. If you’re listing a six-figure car, aiming for a weekend close still looks like the smartest play.

Average Sale Price Top Model by Day of The Week

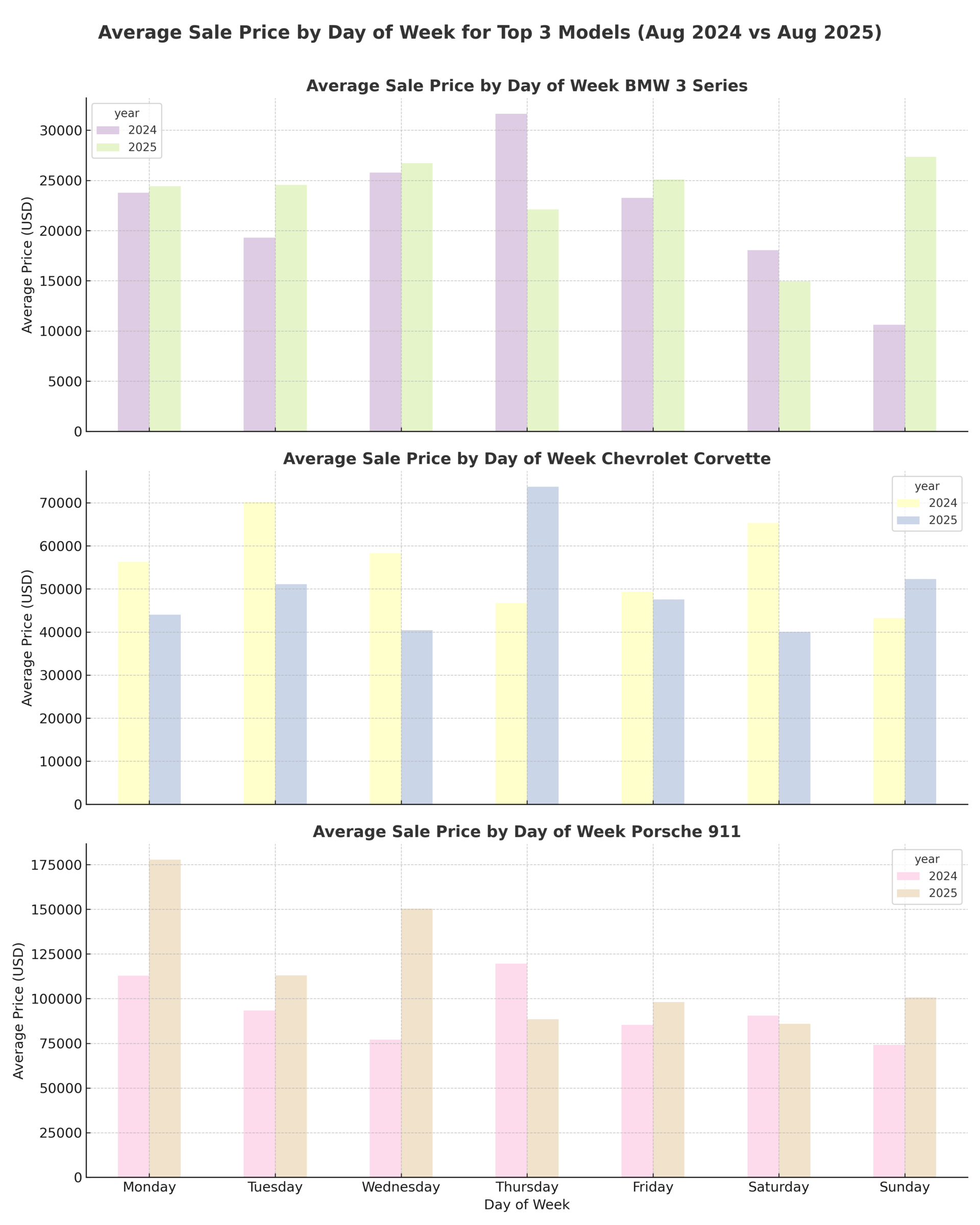

The weekday effect shows up differently depending on the model.

Porsche 911: Prices swung widely. Mondays were strongest, averaging well into six figures, while weekend closes dipped closer to the $80–90k range.

Mercedes-Benz SL-Class: Midweek carried the premium. Tuesdays posted the highest averages, while Wednesday results lagged far lower.

BMW 3 Series: Much flatter, with values clustered in the low-to-mid $20k’s. The only notable edge came on Thursdays, which averaged a few thousand higher.

The takeaway: for high-profile models like the 911 and SL, the day you close can mean a serious difference in results. For mainstream volume cars like the 3 Series, timing has far less impact.

One important note. To get really granular you would need to break this down by decade and then by model year. A 1990s 911 does not belong in the same bucket as a 2020s car. That difference can distort weekday averages. We do not have the luxury to share all of that detail today as this newsletter would never end!! And as you can imagine there is a lot more we could show. But even at this level the story is clear. Timing matters.

Do you want to see more deep-dive analysis like this in future newsletters?(make a comment and let me know what type of stats you wanna see) |

Reply