- The Daily Vroom

- Posts

- 🚗 Cars & Bids Layoffs: What’s Really Happening

🚗 Cars & Bids Layoffs: What’s Really Happening

PLUS: Private Equity Pressures, Niche Challenges & the Analog Gap

The Daily Vroom

Good morning Vroomers!

Yesterday, I mentioned layoffs but held back on naming the company (Cars & Bids) until I had the full picture. After speaking with numerous people today, I have that clearer picture. First, I want to thank everyone who reached out in these uncertain times, especially those looking for new opportunities. I’ll do my best to help where I can.

Now that the details are clear, this isn’t just another round of cuts—it’s part of a bigger pattern. Leadership shake-ups, restructuring, and a platform that should be thriving but keeps running into the same roadblocks. On paper, there’s no reason it shouldn’t be scaling. And yet, here we are.

We’ll get into it below—what’s really going on, why the current approach isn’t working, and where I see a real way forward.

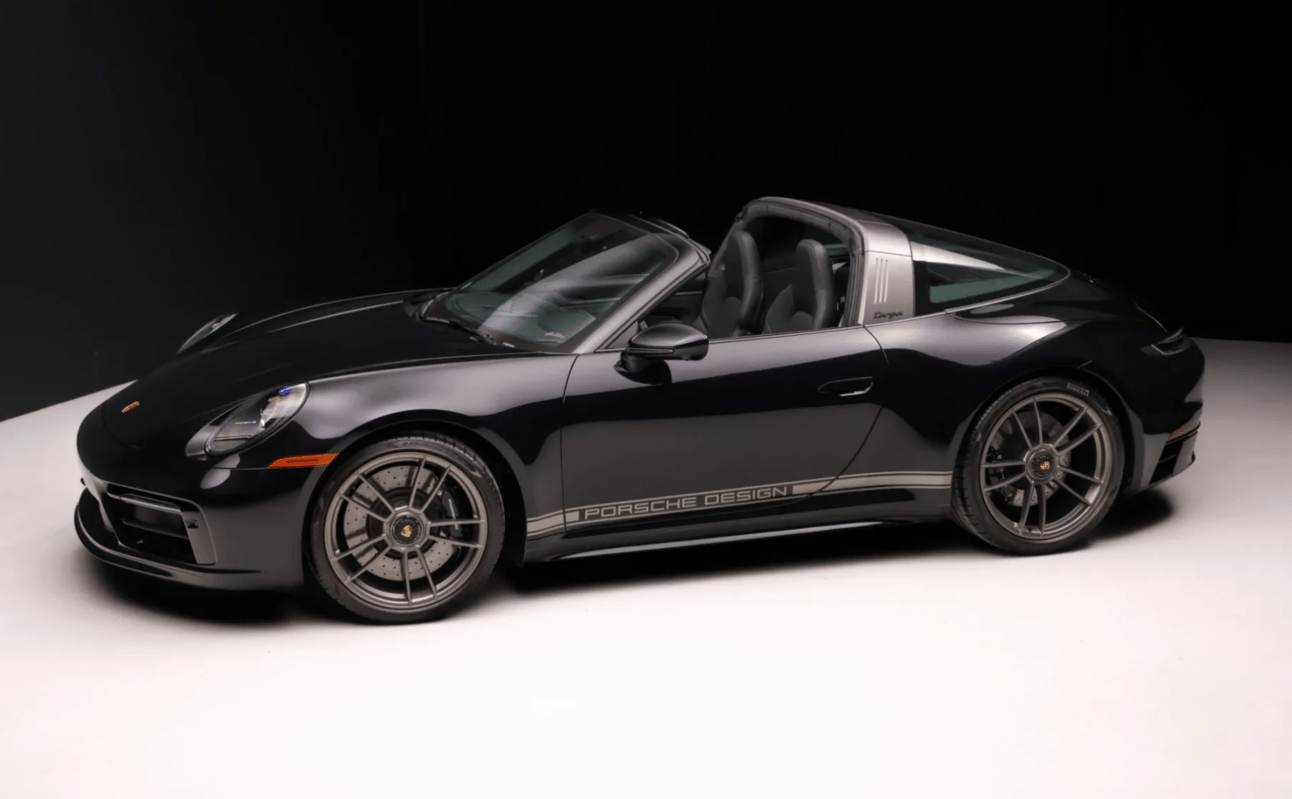

YESTERDAY’S TOP 5 SALES

SOMO came close to a record-breaking sale, with their Regera listing hitting $2.6M—the highest bid ever on their platform. No doubt they’ll be working to close the deal post-auction.

Further down, it’s great to see a diverse mix in our top 5 today, with Collecting Cars and PCarMarket joining BaT on the leaderboard..

Want to dive deeper into any of these listings? Just click on the car to take you directly to the listing.

Cars & Bids Layoffs: What’s Really Going On Here?

The other day, I was hyping up Cars & Bids for hitting a 100% sell-through rate—something they haven’t done since the early days. Big win, right? But turns out, behind the confetti and Doug DeMuro’s quirky video outros, things were messy. Again.

Yep, more layoffs and this time unfortunately a lot more brutal. Sales team - gone. Marketing team - gone, Moderation team - gone.

This comes just weeks after they brought in a new CEO. And let’s not forget last year’s drama: 25% of the staff got axed, including the CEO. Now, with a “streamlined” team, C&B’s running on fumes. So… what’s the deal?

Before we get there, here’s what Doug DeMuro had to say:

“Cars & Bids is making changes to our organization to better support our buyers and sellers. Sometimes those are difficult decisions, and they never come easy — but we’re confident that the best is yet to come from Cars & Bids.”

Fighting talk from Doug 🥊

Chernin Group’s “Oops” Investment

Here’s the thing: The Chernin Group bet big on C&B, dropping $37 million into the platform in 2021. If you’ve followed their plays—Barstool Sports, Headspace, etc.—you know they’re not here to nurture startups. They want rocketships.

The goal? Crush Bring a Trailer, scale to unicorn status, and print money. The reality - Growth flatlined. Sales dipped from their 2023 peaks. So TCG did what private equity does best: reboot, cut costs, and hope.

They threw cash at ads and content, betting it would bring in more sellers. Did it work? Nope. Listings are still hovering at 20-25 cars a day—great for a regular business, not for a VC-backed one.

Now, after installing yet another new CEO, they’re slashing teams again. Is this just rearranging deck chairs on the Titanic? Or is there actually a strategy this time?

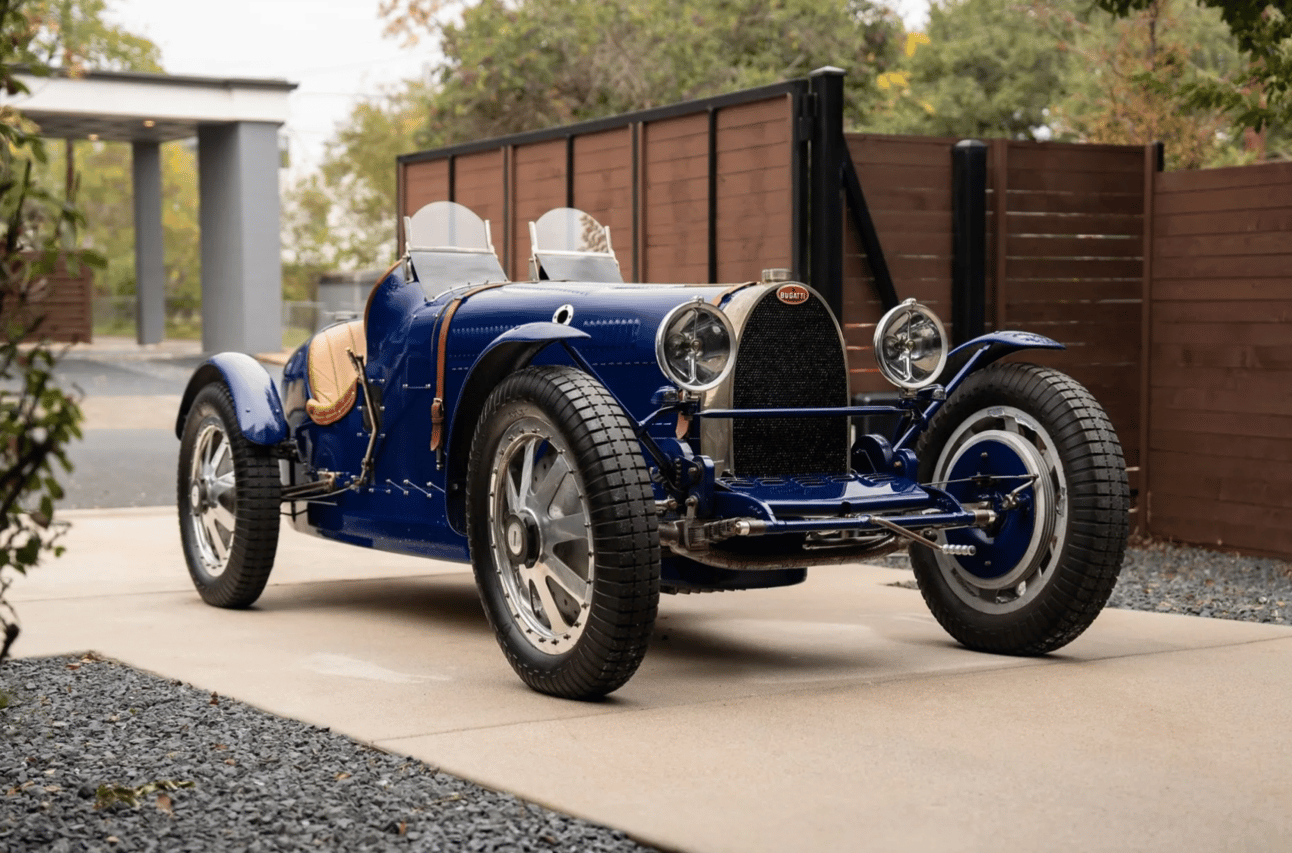

Doug’s Niche Problem: “No Old Cars!”

C&B’s modern-only rule made sense early on—focus on cars 25 years or newer, build a younger audience, and own that niche. And it worked.

But here’s the problem: some niches don’t scale. When TCG invested, you know the conversation happened—“How do we grow? Should we expand into vintage cars?” Doug’s likely response? “No need—let’s just make more content and ads!”

And to be fair, that got him to the point of selling out. But a few years down the line, it’s time to rethink.

If you don’t at least test expanding into older cars, how do you know it won’t work?Sure, you’d need experts for ‘70s classics, but imagine a killer video series on vintage BMWs or air-cooled Porsches bringing in new traffic. Instead, C&B’s stuck in the same lane, betting on more ads and podcasts to fix everything.

Content ≠ Community (And Why It Matters)

Speaking of content: C&B’s all-in on YouTube and socials. Doug’s videos, gold—at least, if you like Doug. But let’s be real—social media followers don’t magically turn into auction bidders.

Just look at SBX Cars: massive audience, meh results.

So what’s missing? On-site content. Buyer guides, deep dives, real stories about the cars on their platform. Stuff that actually drives SEO, trust, and—most importantly—makes the brand feel human.

The Digital Trap: Why Online-Only Isn’t Enough

C&B’s whole vibe is digital-first. Doug’s YouTube empire, slick auction listings, Instagram eye candy—it’s all screen-deep. And hey, that works… until it doesn’t. Because here’s the thing: you can’t algorithm your way into a loyal community.

C&B seemed to think throwing more money at ads and content would be the magic fix—that if they just kept scaling, the users would come. But they didn’t.

This is a tactile hobby. People want to slam doors, smell gasoline, and argue about turbo noises over a hood. Collecting Cars gets this. BaT gets this. They’ve nailed the hybrid model—killer online auctions plus real-world events that build trust and community.

C&B needs to do the same. Host events, meet-ups, get in front of real buyers and sellers. Yes, it’s work. No, you can’t slap a clean ROI on it. But it works.

Let me tell you a quick story: At a recent BaT event, everyone wore name badges with their BaT usernames. “TurboTom92” wasn’t just a comment-section troll—he was a real person, geeking out over a slammed Civic. “MiataMeg” high-fived “JDMStan” over a mint RX-7. Suddenly, the platform wasn’t just pixels—it was people. That’s how you turn online chatter into real-world loyalty.

Meanwhile, C&B’s strategy is stuck in 2020: “If we build more viral Instagram/TikTok clips, they will come.”

Spoiler: They won’t.

The “Cheap C&B” Perception

Another BIG headache: People think C&B’s where you go for deals, while BaT’s for big spenders. Sometimes that’s true—but mostly, it’s a myth. You can snag steals (or overpay) anywhere if you do some research. But that reputation, it’s scaring off premium sellers. If C&B wants growth, they need to shake the “discount” vibe and prove they’re not just for budget builds.

Wild Card Theory: Will Doug Pull a Dave Portnoy?

Here’s a spicy take: What if Doug buys C&B back from Chernin? You know, like Dave Portnoy repurchasing Barstool Sports (for a $1!) after Penn Entertainment dumped it. Doug’s made his life changing money already. Could he just say “screw scaling” and run C&B as a passion project. A cozy, niche site for modern cars with zero pressure to “go big”.

Honestly, I hope not. Sure, it’d be less stressful for Doug, but it’d feel like giving up. C&B’s got too much potential to be a “nice little earner.” They need to evolve, not retreat. Plus, Doug’s competitive—you don’t build a brand this sticky without wanting to win. But hey, money talks. If Chernin’s itching to bail, maybe Doug’s the only lifeline left.

So… Now What?

New CEO, smaller team. TCG’s probably eyeing the exit. But maybe there’s hope:

Test older cars. Dip a toe into the ‘70s with curated listings.

Host IRL events. Even tiny meetups build hype.

Fix the content mix. Less TikTok, more useful website stuff.

Stop pretending ads are the answer. Go meet your users!

Look, C&B’s not doomed. But if they keep doing the same things they’ll just fade into “that site Doug does.” And that’d suck.

I’m REALLY hoping Dan, the new CEO can turn this around, because a strong C&B means a stronger auction space for everyone.

What’s the BEST way for Cars & Bids to grow? |

🛑 STOP! |

If you’re enjoying The Daily Vroom, then please pay it forward by sharing this newsletter with an automotive aficionado in your circles. Your endorsement allows us to accelerate our growth. |

Send them to thedailyvroom.com to subscribe for free.

Reply