- The Daily Vroom

- Posts

- Mecum Kissimmee 2026: Records, Reality, and a Big Question

Mecum Kissimmee 2026: Records, Reality, and a Big Question

PLUS: The BaT listing that went sideways, and why the response mattered

The Daily Vroom

Good morning Vroomers,

It’s been an eventful weekend. The highest online sale of the year so far landed on Friday, with a 2023 Bugatti Chiron Pur Sport selling for $3,821,000. Credit to DuPont’s auction platform for getting that deal done. And at a price that feels remarkably reasonable given recent Chiron sales.

At the same time, the biggest talking point, at least in my circle, has been Mecum Kissimmee. The sale delivered record after record and raised some important questions, not just about the top end of the collector car market, but about where online platforms fit into that future.

Below, we break down the key results and what they might mean next.

The Mecum Kissimmee 2026 Results: Record Ferrari Sales and What They Mean for the Online Auction Market

Mecum Kissimmee 2026 will be remembered as one of the strongest live auction performances in recent memory. Record prices fell across the board, confidence was unmistakable, and buyers showed up in force. And yet, the sale everyone focused on most produced the most nuanced conversation. The only Bianco Ferrari 250 GTO sold for $38.5 million including buyer’s premium, a staggering number in absolute terms and a surprisingly restrained one within the GTO universe.

This GTO was never positioned to chase the highest prices ever paid for the model. It does not have matching numbers. It does not retain its original engine. Those realities place a clear ceiling on value. The car had also been offered privately for some time with no meaningful traction, likely because the asking price did not align with market expectations. That context matters.

What stood out was the bidding behavior. Progress up to roughly $35 million was measured rather than aggressive, with no sense of urgency or momentum building early on. That pacing suggested discipline, not hesitation. Buyers appeared fully aware of what the car was and what it was not.

The buyer, David Lee, is no stranger to top-tier Ferraris. Anyone familiar with the modern collector landscape, knows he owns one of the most significant Ferrari collections in the world. This was not an emotional stretch. It was a calculated acquisition. And at $38.5 million, given the car’s known shortcomings, the result arguably represents strong value. The seller, however, was almost certainly hoping for more.

That naturally raises the question of venue. Was Mecum the right place for this car. Possibly. But not definitively. RM Sotheby’s and Gooding continue to project a different type of exclusivity at the very top of the market. Their environments are more controlled and more curated, and that focus can sometimes translate into deeper bidding for ultra blue chip cars. Mecum’s strength is scale and energy. That scale works exceptionally well for most consignments, but when multiple record level cars share the spotlight, even a $40 million icon can struggle to fully dominate the narrative.

What makes the GTO result particularly interesting is that it stood apart from the rest of the week. Nearly everything else delivered results that felt anything but restrained.

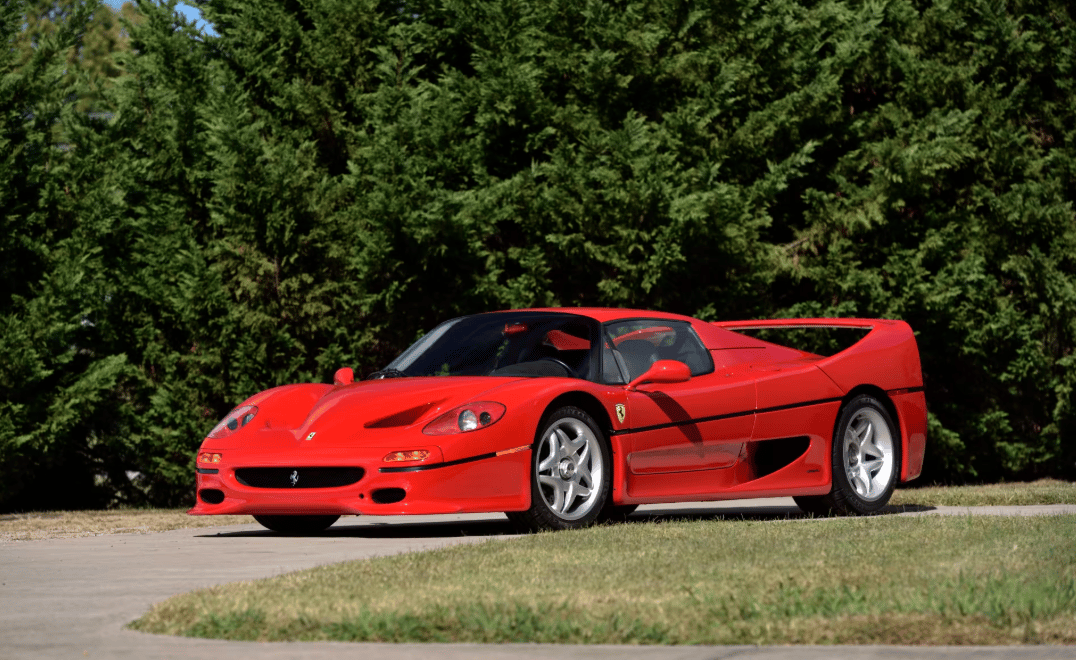

The Bachman Collection produced a string of world records. A Ferrari F50 sold for $12,210,000, roughly $3 million higher than the previous record set just five months earlier at RM. A 2015 Ferrari 458 Speciale Aperta brought $3,080,000, nearly doubling the last record of $1.65 million. And the result that truly reset expectations was the 2003 Ferrari Enzo, which sold for $17,875,000, despite a specification that many would describe as merely average.

Some have searched for explanations. Tax strategies. Market manipulation. Coordinated bidding. None of those theories hold much weight here. This was not a 501(c) charity auction, so there was no charitable tax treatment in play. There were also numerous buyers, not just one or two. Different bidders competed across multiple cars. What this looked like was confidence, not conspiracy.

In the hours following the sale, some speculation emerged around whether the structure of the Bachman Collection, which benefits a charitable foundation, may have influenced bidding behavior. The theory is that any amount paid above a perceived fair market value could be treated differently for tax purposes, potentially encouraging more aggressive bids.

What is important to note is that this was not a traditional charity auction, and a bidder’s full purchase price is not automatically deductible. Any tax treatment would apply, if at all, only to a portion above fair market value, and even that depends on individual circumstances. More importantly, there is no clear evidence that this dynamic alone explains the breadth or scale of the record prices achieved. Multiple buyers competed across multiple cars, suggesting confidence in the assets themselves rather than a tax-driven anomaly.

Once records like these are established, they do not exist in isolation. Sellers will now walk into RM, Gooding, Broad Arrow, and Mecum offices pointing to these results and asking how to go higher. The ceiling has been raised, even if not every car will reach it.

From an online auction perspective, Kissimmee was especially instructive. One detail stood out immediately. Fees. The Enzo hammered at roughly $16.5 million, with an 8.33 percent buyer’s premium pushing the total to $17.875 million. Traditional auction houses are structurally designed to capture that upside.

As many of you know online platforms operate very differently. Most cap buyer fees at a fixed amount, often $7,500 and sometimes $25,000 at the high end. That model works exceptionally well for daily auctions and even seven figure cars. It is part of why online platforms have been steadily taking share from live auction houses year after year. But when cars begin trading at eight figures, that same structure leaves meaningful value on the table.

At the same time, online platforms possess advantages that traditional houses do not. Data. Transparency. Audience reach. Behavioral insight. With the right structural tweaks, such as curated high value events, differentiated presentation, and more tailored buyer engagement, there is no fundamental reason online platforms could not compete more aggressively for the top tier of the market.

One final detail about the white GTO is worth noting. Much is often made of the importance of being in the room. The buzz. The theatre. The social aspect of bidding alongside other collectors. All of that makes sense in theory. But in this case, the winning bid was placed by a broker acting on behalf of David Lee, not by the buyer himself in the room. The decision making, the bidding, and the execution were already one step removed from the auction floor. If that same broker had been bidding through an online platform, functionally very little would have changed. The room mattered symbolically, but not operationally. What did matter was credibility, trust, and access to the right buyers.

Which brings us to the real question.

What would it take for an online auction platform to successfully sell a $10M+ car? |

🛑 STOP! |

If you’re enjoying The Daily Vroom, then please pay it forward by sharing this newsletter with an automotive aficionado in your circles. Your endorsement allows us to accelerate our growth. Send them to thedailyvroom.com to subscribe for free. |

A Wake-Up Call for Online Car Auctions

We have all seen fake listings before. Craigslist. Facebook Marketplace. The usual routine with stolen photos and a rushed deposit request.

What made this one different is that a BaT auction for a 1999 Cadillac DeVille went live with a photo gallery many users believed was AI generated or manipulated, and it took sustained community pushback before the listing was pulled.

The car itself was almost irrelevant. What mattered was that the listing went live, stayed live, and required the community to force the issue before action was taken.

Users were furious, and not just at the seller. The frustration was aimed squarely at BaT for how long it took to respond and how the situation was communicated once they did. Yes, this unfolded over a weekend. Yes, there was likely skeleton staff working remotely. But this is exactly the kind of scenario where a real escalation system should exist. If a listing suddenly generates an abnormal number of flags, comments, or credibility concerns, someone should be pinged immediately and empowered to pause the auction.

What truly poured fuel on the fire were BaT’s first two public responses.

The initial message said they were working with the seller to obtain additional photos. That completely missed the tone of what was happening. The issue was not that there were too few images. The issue was that the images already posted appeared manipulated. Asking for more photos sounded like BaT had not yet grasped the severity of the concern.

The second message, issued when the auction was eventually canceled, stated that the seller was unable to provide additional photos. That explanation landed just as poorly. It framed the problem as a logistical failure rather than a trust failure, which further frustrated a community that was already upset.

Only after that did BaT directly acknowledge AI manipulation, take responsibility for missing it in the review process, and apologize clearly and profusely. That response finally matched the gravity of the situation, but by then the damage had already been done.

Mistakes happen. Most users understand that. What people struggle to accept is when a platform built on trust and curation responds slowly to a credibility issue and communicates in a way that feels procedural rather than empathetic. In those moments, tone and timing matter as much as the fix itself.

Online auctions run on trust in the inputs. Photos are not just decoration. They are the foundation. In a world where AI can generate convincing imagery in minutes, platforms are going to need stronger guardrails, faster escalation, and clearer communication, especially outside normal business hours. Hopefully this is a learning point for everyone, not just BaT.

Because next time, it will not be a 1999 Cadillac DeVille.

Reply