- The Daily Vroom

- Posts

- The Truth About Bid Shilling...

The Truth About Bid Shilling...

PLUS: Three wildly different no-reserve plays

The Daily Vroom

Everyone Plays the Game

Every few years the collector car market goes through the same ritual. A platform gets called out, a few auctions look questionable, someone posts a suspicious bid history, and suddenly the conversation turns into outrage, as if we’ve uncovered some grand conspiracy threatening the integrity of the entire system. There’s a rush to assign blame and a lot of performative shock, but very little acknowledgment of something much simpler and much older: auctions have never been perfectly clean environments. They’ve always been human environments, and humans, especially when money is involved, have always tested the edges.

The truth is less dramatic than the headlines suggest. Whenever you create a marketplace where prices are determined in real time and a single bid can swing the outcome by hundreds or thousands of dollars, you create incentives. And once incentives exist, someone somewhere is always going to push a little, probe a little, or try to “help” the number along. Not because they’re cartoon villains and not because the platform is uniquely broken, but because that’s how markets behave. Auctions aren’t spreadsheets. They’re psychology.

Which is why the recent noise around EBlock shouldn’t really surprise anyone who understands how this industry actually works.

For most enthusiasts, eBlock barely registers. But inside the wholesale world, it’s a major artery, one of the largest dealer-to-dealer digital marketplaces in North America and a place where serious volume quietly trades hands every day. Thousands of cars move through it before they ever show up on enthusiast platforms, and for many vehicles this is where the real price discovery happens. It’s the plumbing of the industry, not the showroom.

So when allegations surfaced that certain dealers coordinated bids to lift prices, some corners of the internet treated it like a bombshell. In reality, it felt more like inevitability. When sellers make more money if the hammer falls higher, and when small bumps can compound into meaningful margin across dozens or hundreds of transactions, someone is always going to convince themselves that a little nudge here or there isn’t a big deal. Add a few hundred dollars on one car, repeat that behavior across a portfolio, and suddenly it’s real money.

That isn’t a wholesale problem. It isn’t even really a dealer problem. It’s an auction problem.

Because the exact same pressures exist everywhere auctions exist, including the consumer platforms we like to think of as cleaner and more transparent.

Over the last decade, the likes of Bring a Trailer and Cars & Bids have done something genuinely important by dragging this market into the open. They exposed pricing, flattened access, and replaced the old backroom dealer networks with public bid histories and visible usernames. Compared to how things used to work, it’s night and day. Thousands of eyes watch every listing. Comment sections act like real-time audits. The crowd often spots strange behavior faster than any compliance team could.

In most cases, these platforms function exactly the way you’d hope they would.

But “better” doesn’t mean “immune,” and online doesn’t magically eliminate human behavior. It just changes the tools.

If you read the terms of both sites closely,( I read them) both companies describe themselves the same way: they’re venues, not principals. They connect buyers and sellers, enforce rules, and remove bad actors when they find them, but they aren’t controlling what every person behind a keyboard decides to do. They can design friction and increase transparency, but they can’t guarantee that every bid is perfectly organic any more than a live auctioneer can guarantee that every paddle in the room is acting in perfect faith.

So enforcement becomes practical rather than theoretical. You catch what you can. You rely on visibility and reputation. You make it risky enough that most people don’t bother trying.

And honestly, the community does half the policing anyway. Anyone who watches these auctions closely has seen how fast something suspicious gets flagged. A brand-new bidder with no history suddenly starts throwing around big numbers and within minutes people are connecting dots, checking locations, and asking questions. That collective memory is powerful, and it’s one of the biggest reasons these sites feel fundamentally more trustworthy than the opaque systems that came before them.

Still, it would be naïve to pretend nothing ever slips through.

Because if someone really wants to influence an auction, they don’t need a dramatic fake bid. They just need subtle pressure. An older dormant account. A friend placing an early number. A small push that creates momentum. Nothing big enough to look like fraud, just enough to keep the price moving until two real bidders take over and convince themselves it’s worth stretching a little further. Once that emotional momentum kicks in, the market does the rest.

And that’s the uncomfortable truth: you don’t need a fake $20,000 bid to change an outcome. Sometimes all it takes is a $500 nudge at the right moment and two legitimate bidders will happily carry the price far beyond where it would have landed otherwise. Auctions are emotional environments. Every extra bid validates value. Every new participant signals demand. Logic quietly gives way to competition.

And it’s not like live auctions are some gold standard either.

Earlier this year at Mecum Auctions, everyone watched a moment where the hammer fell, the car was declared sold, and then bidding continued anyway. Maybe it was timing, maybe it was discretion, maybe it was procedural, but to bidders in the room it simply felt like the rules changed after the play. And if we’re being honest, it didn’t feel like an innocent one-off. Anyone who has spent time on a live auction floor knows those teams are masters of momentum. The chant, the spotters, the pauses, the “one more,” the split-second reopenings, it’s theater designed to keep bidders leaning forward and stretching past the number they promised themselves they wouldn’t cross. That isn’t shilling in the traditional sense, but it is psychological engineering, and live auctions have spent decades perfecting the art of getting people to overspend.

That’s the game too. Sometimes exciting. Sometimes effective. Occasionally a little uncomfortable to watch. Which is really the bigger takeaway. This isn’t an online problem or a wholesale problem or a Mecum problem. It’s simply the nature of auctions. Maybe calling it a “scandal” misses the point entirely. Maybe it’s just the cost of doing business in any competitive marketplace where money and emotion collide. Every industry has people who test boundaries and look for an edge. Cars aren’t special.

The goal was never perfection. That’s fantasy. The goal is friction. Make questionable behavior harder. Make it visible. Make it reputationally expensive enough that most people decide it isn’t worth it. By that standard, today’s platforms are doing pretty well.

Not flawless. Not pure. Just dramatically more transparent than anything we had before. And honestly, that might be the most realistic expectation we can have, because auctions aren’t supposed to be sterile, they’re markets. And markets are messy.

How do you view questionable bidding or “soft shilling” in auctions? |

🛑 STOP! |

If you’re enjoying The Daily Vroom, then please pay it forward by sharing this newsletter with an automotive aficionado in your circles. Your endorsement allows us to accelerate our growth. Send them to thedailyvroom.com to subscribe for free. |

No Reserve Auctions To Keep An Eye On

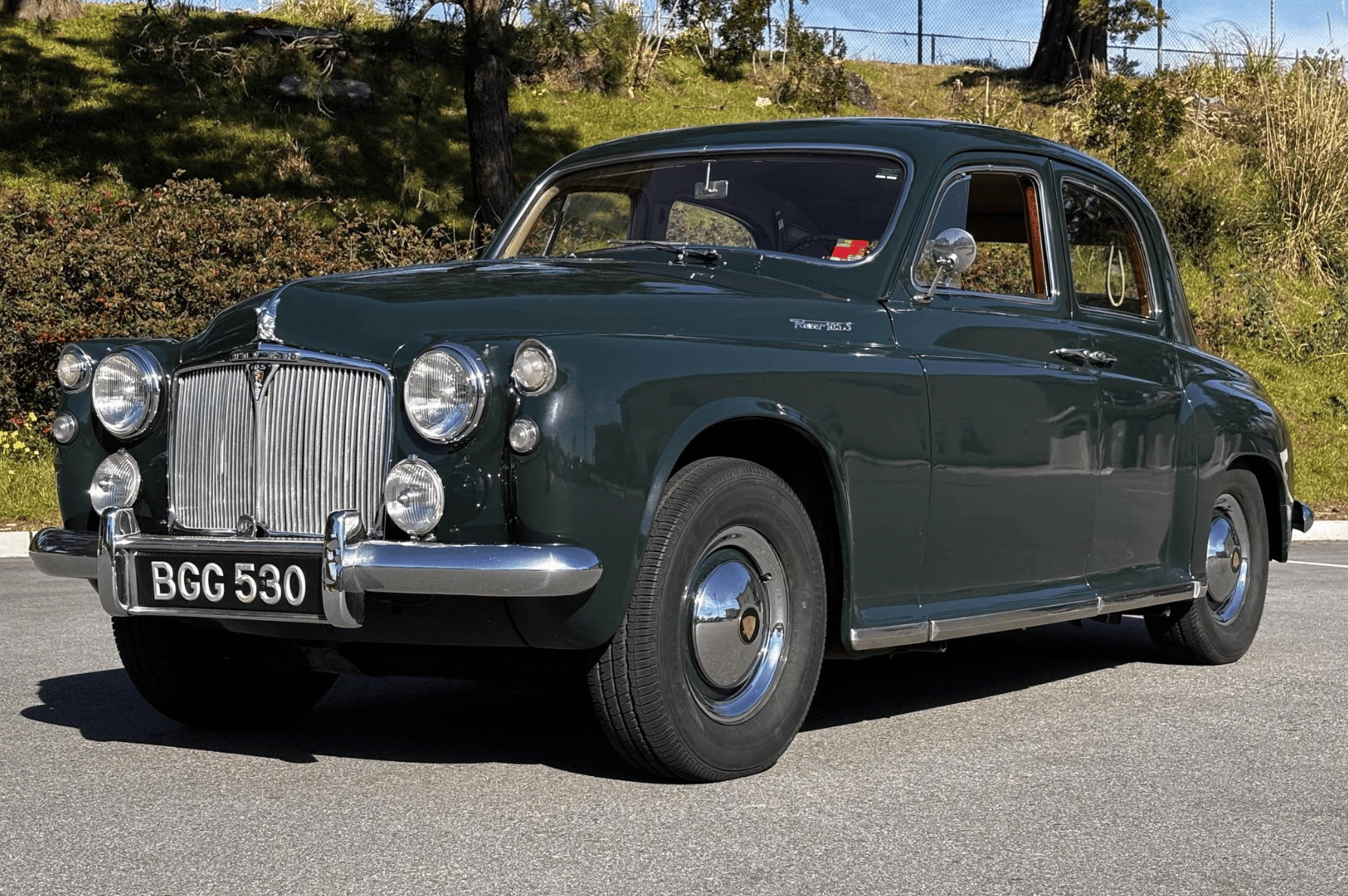

While everyone’s busy chasing GT3s and modern money cars, this is one of those listings that caught my eye.

A 1958 Rover P4 105S on Cars & Bid, that in itself is worth talking about. Straight-six. Four-speed manual. Rear-hinged doors. No reserve. Sitting at basically appliance pricing.

And it has ten times the character. The P4 was Rover’s first post-war sedan, built for quiet British professionals who wanted comfort and dignity, not flash. Leather, wood, thin pillars, bank-vault doors. The 2.6-liter straight-six makes just over 100 hp, but it’s all smooth torque and long-legged cruising, exactly how a car like this should feel.

This one’s left-hand drive and genuinely rare in the US, which makes it even better. Not trendy rare. Just “you’ll never see another at cars and coffee” rare.

Honestly, this is the fun part of the hobby. Not fast. Not hyped. Just interesting. And for no-reserve money, that’s hard to beat.

There’s a no-reserve Mercedes-Benz ML55 AMG on the block right now sitting around seven grand, which feels slightly ridiculous when you stop and think about what this actually is.

This isn’t one of the later “AMG-line” trim packages or a dressed-up grocery getter. It’s a proper early-2000s AMG from the era when Mercedes-Benz still handed projects to engineers and told them to be irresponsible. You get the 5.4-liter M113 V8, over 340 horsepower, full-time all-wheel drive, and the same drivetrain that powered half of Mercedes’ golden-era performance cars, wrapped in a body-on-frame SUV that can tow, haul, commute, and still feel genuinely quick.

What makes this one interesting isn’t just the spec sheet but the condition. Sub-90k miles, a long list of recent maintenance, fresh tires and brakes, and ownership that reads enthusiast rather than neglect. Add in the rare Travertine paint and it’s exactly the kind of honest, well-sorted example these trucks rarely are twenty-plus years later.

The funny part is how the market treats them. People will spend more money on bland modern crossovers without thinking twice, yet this gives you a naturally aspirated AMG V8, proven reliability, cheap parts, and real character for the same price as a used appliance. It sits in that awkward middle ground between “too old to feel new” and “not old enough to be collectible,” which is usually where the best values hide.

At this number, it’s less a gamble and more common sense. If you want a usable, old-school AMG you can actually drive every day without worrying about mileage or depreciation, it’s hard to think of a better answer.

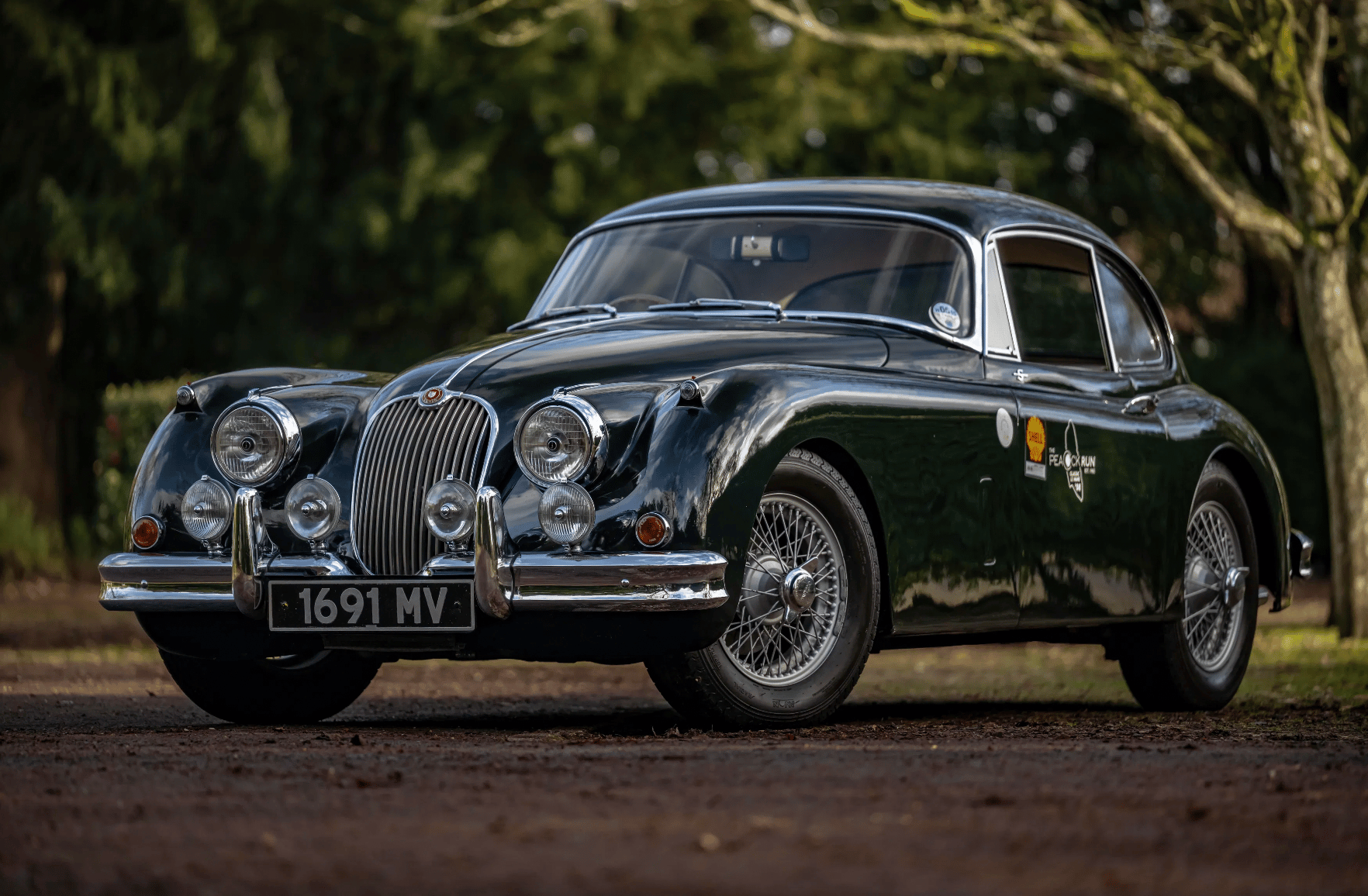

There’s something refreshing about seeing a car like this come to market without a safety net.

A no-reserve 1960 Jaguar XK150 S fixed head coupe, matching numbers and one of just 115 right-hand-drive 3.8 “S” cars built, currently sitting at £35,250 with dozens of bids and plenty of time still on the clock. It’s already clear there’s real interest, but where it actually lands is anyone’s guess, which is exactly what makes it compelling to watch.

The XK150 has always lived in the shadow of the 120 and the E-Type, yet it’s arguably the most complete version of the original XK formula. Jaguar widened the cabin, improved visibility, added proper disc brakes, and paired the chassis with the more powerful 3.8-litre straight-six in “S” tune, turning what had been a beautiful sports car into a genuinely capable grand tourer. It’s quicker, more usable, and easier to live with than the earlier cars, which makes the low production numbers in this specification even more surprising.

That combination of real-world usability, period performance, and genuine rarity is what makes this one interesting. You’re not just looking at another old British coupe. You’re looking at the last and most developed chapter of Jaguar’s original XK lineage, offered the way auctions are meant to be offered, with the market deciding the number.

Wherever it finishes, it’s a reminder that cars like this still show up from time to time, and they tend to be far more interesting than whatever modern metal happens to be trending that week.

Reply