- The Daily Vroom

- Posts

- The Difference Between Theater and Reality

The Difference Between Theater and Reality

PLUS: Why This 2026 Mercedes-AMG G63 Didn't Sell...

The Daily Vroom

Why This Mercedes-AMG Didn’t Sell

A nearly new 2026 Mercedes-AMG G63 with just 300 miles, nicely spec’d, essentially showroom fresh, exactly the kind of vehicle that not long ago would have been treated like easy money. During the Covid years something like this was almost mechanical. Buy it, park it, list it, and someone would happily pay well over sticker just to skip the dealer line. These things felt less like SUVs and more like tradable assets.

The bidding climbed steadily and ultimately topped out at $215k, which honestly was a little stronger than I expected and shows there is still real regard for the G63. People clearly still want them. It was not a soft result. In fact, when the high bidder jumped from $203K straight to $215K in one move, it felt like a knockout punch, the kind of late bid that usually ends the auction on the spot and sends everyone home.

Except it didn’t. Reserve not met. No sale.

And that result probably tells you more about today’s market than any of the headline-grabbing outliers we’ve been talking about lately.

Because when you slow down and actually run the math, it gets tough pretty quickly. If the seller paid somewhere around $200K MSRP, then add sales tax, registration, maybe an ADM, maybe some fees, you’re realistically into this thing for $220K to $235K without even trying.

Now factor in the buyer’s fee ($7,500) on top of the hammer price and compare that to simply walking into the right dealership and ordering one at or near sticker with your own name on the title and zero question marks, and suddenly the auction price stops looking like an opportunity and starts looking like you’re doing the seller a favor.

And buyers aren’t doing favors anymore. That’s the shift.

This isn’t 2021. Money isn’t free, supply is back, and while a G63 isn’t your typical depreciating SUV, it’s also not flip anymore. The automatic profit days are gone. Now the numbers actually have to pencil. People will still pay strong money, but only if it makes financial sense.

In a weird way, this no-sale might actually be more important than the six-figure Cadillacs or the million-dollar Lincolns we talked about yesterday and reference later on in this newsletter. Those are theater. They’re emotional. They’re two bidders getting caught up in a moment. This one is just reality. A clean, rational market saying, “close… but not quite.”

And it leaves the seller in an awkward spot. If $215K wasn’t enough here, where does it go next. Does it try BaT. Would they even take it. Does it head back to a dealer or wholesale lane and quietly trade hands at a loss. None of those paths feel great, which is exactly why flipping brand-new cars isn’t the layup it used to be.

Sometimes auctions are driven by vibes. Sometimes they’re driven by math.

This one was math. And math usually wins.

Room Energy or Real Money?

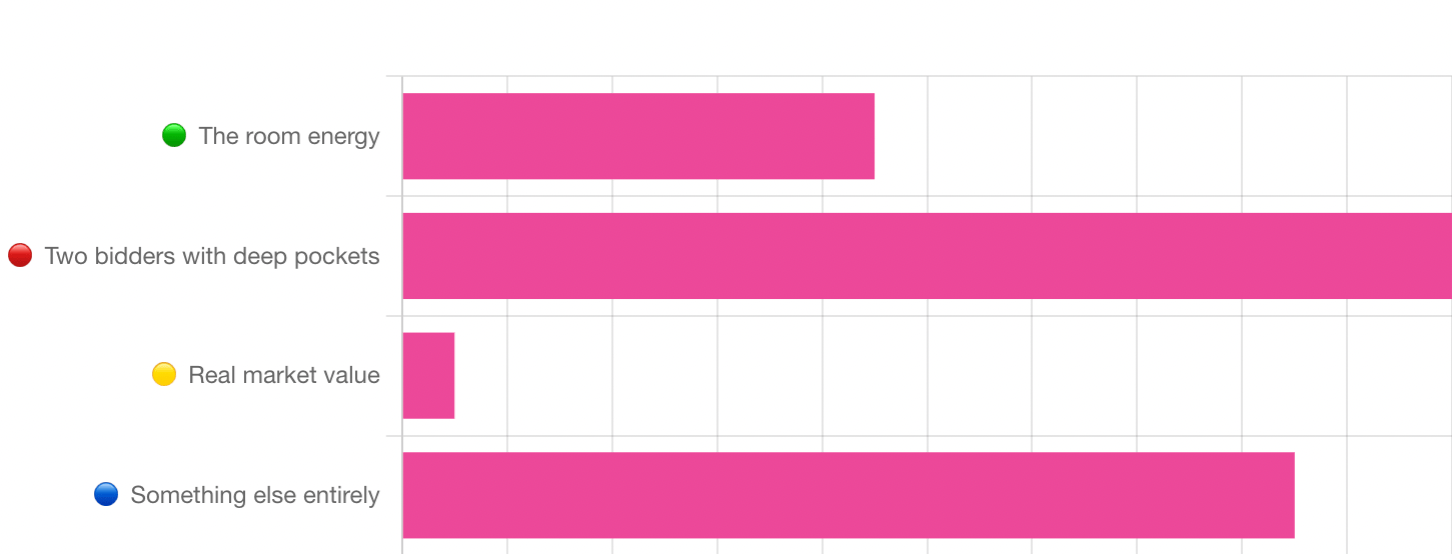

In yesterday’s newsletter we delved into two of the recent BJ auctions that raised some eyebrows with mouth watering sale numbers. And we asked you

“What’s really driving those prices?” Here’s how you answered the poll.

We were inundated with comments. Below are a mixed selection of those comments.

The no reserve model and bidders get free alcohol. Then add a live tv broadcast and a camera on the bidder bidding or worse a bidder that stops bidding on camera, this adds a component of unmeasurable pressure. The results are obvious…

It has to be driven by a combination of alcohol, ignorance, the desire to purchase a car at the BJ yo have seen on TV for years, and two bidders with deep pockets.

Nice, but the Caddy will never be collectible, and the Conny is not the most collectible model. Clowns with more money than sense.

Currently, there is a massive amount of money in need of good homes. Perhaps insider stock options have matured and they're selling, or perhaps this is proceeds of certain risky commercial pursuits. This year is definitely one of strong and sometimes anomalous results. Also much stratification.

Would you tell you closest and most trusted friend something that could land you in jail? NO. Nobody will be certain of the trust however close to the source they think they are.

I agree that the vibe in the room and the free-flowing alcohol has an effect, but it doesn't completely explain results like these. It's tempting to assign one factor to a result, but that's rarely the case.

Lots of things can combine to generate an outlier sale. In terms of risk, both live auctions and online auctions are risky, just for different reasons. Preview days at live auctions allow you to study a car up-close and personal with your own eyes, where an online auction rarely offers the same opportunity.

Perhaps many live bidders don't take advantage of that, preferring to socialize and treat bidding like gambling, but plenty of online bidders also fail to do their diligence. Going to a live auction requires a fair bit of commitment, paperwork and expense, while it's awfully easy to click the bid button on BAT.

Insanely foolish folks. I just don’t get it but you are correct. Seems 1m Lincoln may have been a bit strong but who’s to say!

The usual conspiracy theories aside, the real question I have is whether or not the transaction was completed and money changed hands. One thing is for sure, these sales are a data outlier and not a seismic shift in the market.

Booze!

Conspiracy among bidders to establish an insurance value.

Reading through all your comments, you can feel the split. Some people blame the booze. Some blame ego. Some jump straight to conspiracies. And honestly, I get it. When you see a $12,300 Cadillac suddenly trade for $102,300 or a Lincoln with a questionable underside bring a million bucks, your brain wants a dramatic explanation.

But after years of standing in those tents at Barrett-Jackson and Mecum, the truth is usually much less mysterious and much more human.

Live auctions are engineered environments. Lights, cameras, a packed room, free-flowing drinks, a countdown clock, your bidder number on the screen. It stops being a transaction and starts feeling like a competition. You are not calmly pricing a car anymore. You are trying to win in public. That kind of pressure does funny things to otherwise rational people, and it only takes two bidders on the same wavelength to create a number that makes the rest of us shake our heads. I have seen smart people overpay and I have seen great cars steal because the right two bidders did not show up that day. Same cars, same market, completely different outcomes. That is not fraud or manipulation. That is psychology.

At the same time, it is important not to throw every big number into the same bucket.

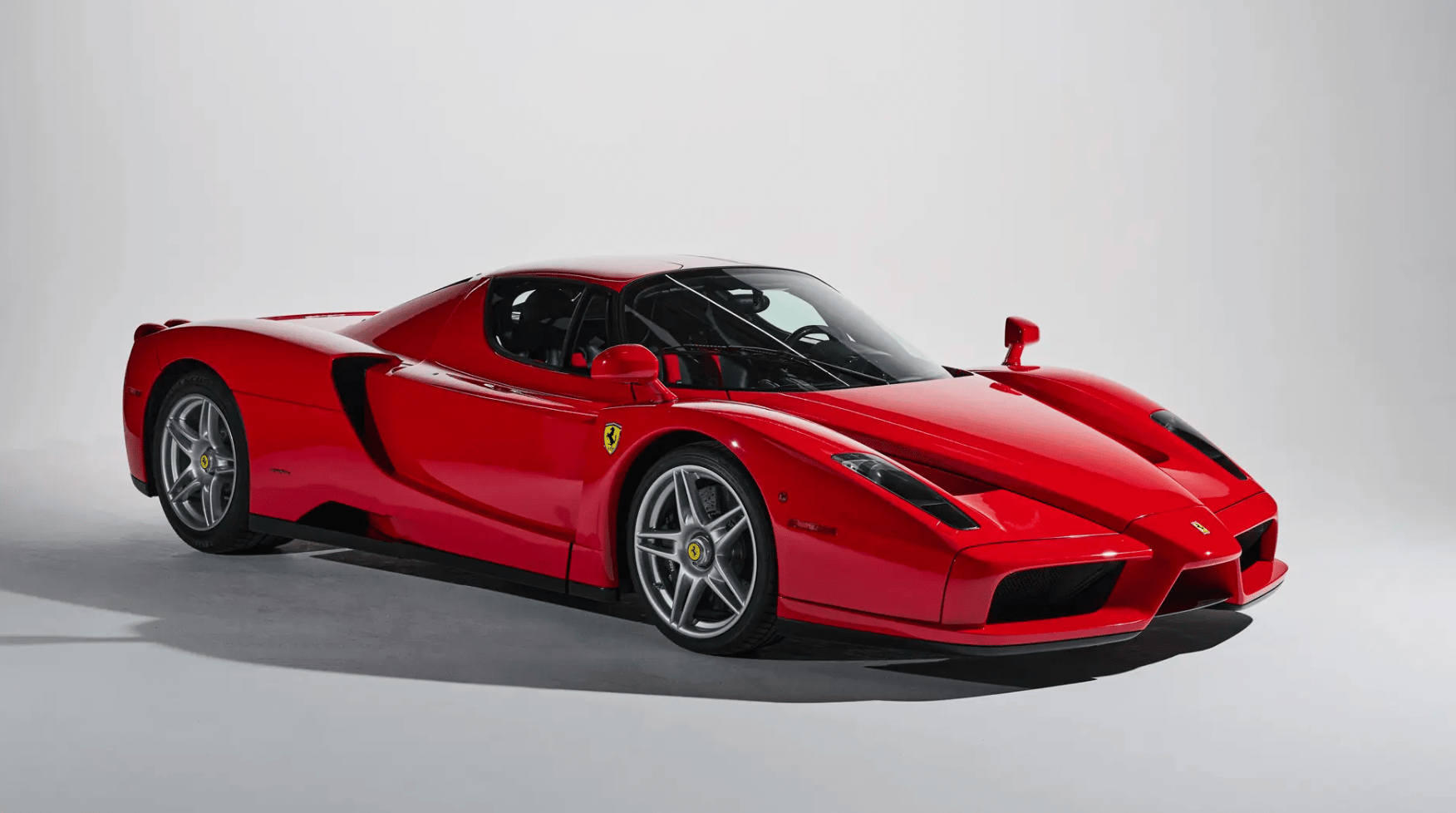

The Fleetwood and the Lincoln feel like classic “room energy” results. Emotional money. Moment-driven. But at the very top of the market, the dynamics are different. A few weeks ago we talked about that Mecum Ferrari Enzo that brought a staggering $17.8 million, blowing past the previous $6.6 million high. That one looked like pure billionaire flexing at first glance, the kind of sale you assume is a one-off outlier. Except it has not stopped there. Since then, another Enzo sold at RM for just over $9 million. Then this week in Europe, where pricing typically runs softer than the US, an Enzo estimated around €4 million hammered for €8.1 million, roughly $9.7 million. That makes four Enzos already this year, across different venues and continents, all comfortably above $9 million.

At some point that is not theater anymore. That is the market quietly resetting.

So there are really two stories happening at once. In the middle of the market, live auctions can produce weird, emotional outliers because the room gets hot and two people refuse to blink. But at the very top, when you see repeat sales, multiple venues, and consistent price levels, that is not vibes. That is capital chasing truly scarce assets.

Which is why I always come back to the same idea. Value is determined in the room on a particular day. Sometimes that room creates nonsense. Sometimes it reveals a real shift. The trick is knowing which signal you are looking at.

And that is what makes auctions endlessly fascinating. They are part market, part psychology experiment, and part theater. Sometimes all three at once.

Enjoying The Daily Vroom?

Pay it forward by sharing this newsletter with an automotive aficionado in your circles. Your endorsement allows us to accelerate our growth.

Send them to thedailyvroom.com to subscribe for free.

Reply